Do You Pay Taxes on Your Savings Account?

When you deposit money into a savings account, it can earn interest. This is taxable income according to the Internal Revenue Service. This includes traditional savings accounts, money market accounts and certificates of deposit. You can report this income on Form 1099-INT.

Generally, the IRS taxes savings account interest at your earned income tax rate. However, there are some ways to minimize your tax burden.

Taxes on interest

Savings accounts are a popular way to save money, and the IRS taxes the interest earned on these funds. The tax on savings account interest is the same as for other income, including salaries, and it applies whether you withdraw the funds or leave them in the account. You must report the interest on your annual tax return. You can track your earnings throughout the year in a spreadsheet or other accounting software. You can also receive a 1099-INT from your bank or credit union showing the amount of interest you earned, and you can use this to verify your own records.

Most types of savings accounts pay interest, including traditional savings, high-yield savings, and money market accounts. In addition, the IRS taxes the interest earned on CDs, which are investments that can be withdrawn after a specific period of time, ranging from months to years. The tax on savings account interest is not as high as the tax on earnings from most other types of investments, but it’s still a significant burden for many people.

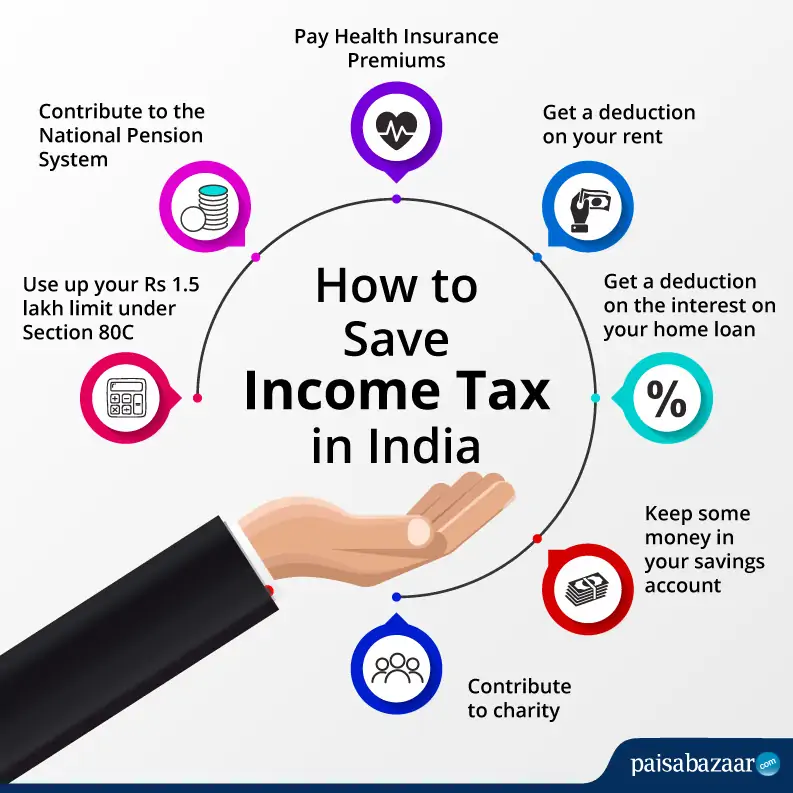

Fortunately, there are ways to minimize your tax obligations on savings accounts. You can invest in a tax-deferred retirement or education account, or you can choose a savings account that pays interest at a lower rate. In addition, you can consider a bank or credit union that offers special tax treatment for savings on education and retirement.

Taxes on withdrawals

Savings accounts provide a convenient way to save money for emergencies, college tuition, or retirement. However, they can come with certain tax consequences. Understanding the impact of taxes on savings account earnings is important to ensure you get the best returns on your money. The Internal Revenue Service (IRS) taxes interest income at your regular federal income tax rate, regardless of how the income is earned or where it comes from.

If your savings account earns taxable interest, the financial institution that holds it will send you a 1099-INT tax form in late January for the year’s interest. You can also expect to receive a form for any cash bonuses that you may have earned for opening a new savings account, as these are taxable.

You must pay taxes on the taxable interest that you receive from your savings account, but not on the principal balance of the account. This is because the IRS treats your savings account interest as income, just like income from a job or other sources of taxable income.

In addition to traditional savings accounts, many other types of accounts offer taxable interest, including checking accounts, certificate of deposit (CDs), and money market accounts. These accounts are taxable the same as savings accounts, and the IRS expects you to keep accurate records and file your taxes accordingly.

Taxes on dividends

A savings account is a safe place to store your money, but it doesn’t come without taxes. The Internal Revenue Service considers most interest income from a savings account to be taxable and requires that you report it on your tax return. Most financial institutions will share this information with you on a form called 1099-INT. This form shows any taxable interest you’ve earned in the previous year. In addition, if you accept a cash incentive for opening a new savings account, that bonus is also taxable.

The amount of taxes you pay depends on your marginal tax rate, which is based on ordinary income. You may also be subject to a 3.8% net investment income tax (NIIT), which is charged on certain types of interest and dividends.

In general, the IRS taxes your savings account interest at your regular federal tax rate for the year in which it is earned. You can claim this interest on your tax return using Form 1040.

While most savings accounts don’t come with major tax advantages, they can help you save for retirement, education and healthcare expenses. You can also avoid paying taxes on your savings with special tax-advantaged accounts designed specifically for these purposes, which often come with restrictions on when and how you withdraw your funds. These types of accounts typically offer higher interest rates than conventional savings accounts.

Taxes on certificates of deposit

CDs allow you to earn more interest than you can get in a standard savings account, but you need to know that your earnings are taxed. The IRS considers them taxable income, and you need to report it on your tax return. This can be a big surprise if you are not expecting to pay taxes on your CD interest. The good news is that you can minimize your tax burden by arranging for enough money to be available outside of your CD to cover the tax obligation each year.

Each year, you should receive a copy of Form 1099-INT (or 1099-OID for IRA accounts) from your bank or credit union by January 31. This form shows all of your taxable interest and tax-exempt income for that year, and it should be reported on line 2b of your federal tax return.

The tax rate you pay on your CD income depends on the amount of interest you earn and your tax bracket. However, you may be able to reduce your tax liability by depositing your money in a CD with a shorter term.

You can also avoid paying taxes on your CDs by saving them in a tax-deferred account, such as an individual retirement account or 401(k). These accounts are typically funded with pretax dollars and don’t earn taxable interest until you make withdrawals at retirement age.